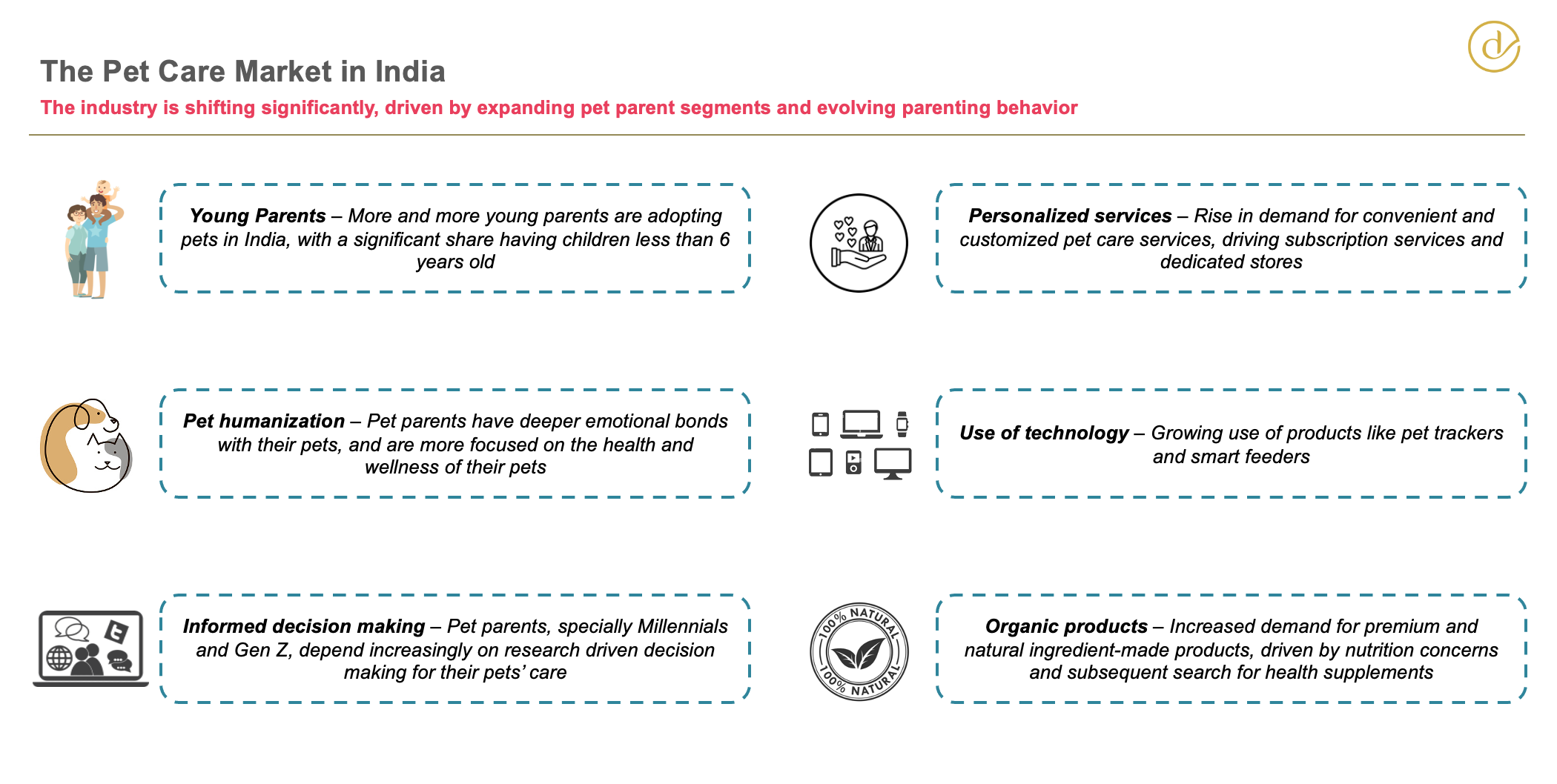

What is driving growth in the pet care market?

The pet care market in India is estimated to grow from $3.5 billion in 2024, to about $7 billion in FY28, as pet parents increasingly priortise the health and wellness of their furry companions. The key trends driving this growth are -

10 things to remember while reaching out to investors

1. Know your audience: Research the investor’s investment history and interests, and

personalize the message to build a connection.

2. Clarity: Investors are often inundated with emails/messages. Use clear language and

communicate the most important information upfront.

3. First impression counts: Look to use a hook to create a compelling introduction. The

goal is to capture attention. Communicate purpose of outreach.

Equity and debt financing are two primary methods that businesses use to raise capital, and

these two methods differ in several key aspects:

1. Nature of Financing:

a. Debt: Businesses are borrowing money from lenders, such as banks, financial

institutions, or individual investors, with a promise of repaying the principal

amount with interest, for a specified time period. Debt does not involve parting

with ownership stakes in the firm.

The decision to bootstrap your business, is a double-edged sword. While there are clear

advantages to the founder, in terms of autonomy, financial discipline, and the potential for

full ownership, it also comes with significant challenges – such as limited resources and

potential personal financial risk.

The choice to bootstrap, should be based on the company’s business model, growth targets,

risk tolerance, and the industry.

Below are some clear pros and cons –